Why Roblox Stock Could Soar 75% After the Q3 Dip

If the analyst responses to the Q3 earnings results serve as a guide, the Q3 pullback in Roblox's (NYSE: RBLX) stock presents a compelling buying opportunity. Analyst revisions tracked by MarketBeat reveal a mixed response, to be sure, including a few price target reductions.

However, the few reductions are offset by price target increases and even ratings upgrades, and are themselves aligned with an above-consensus forecast.

The takeaway is that positive analyst sentiment strengthened in the wake of the report, but with signs of caution, indicating significant upside potential for the gaming stock.

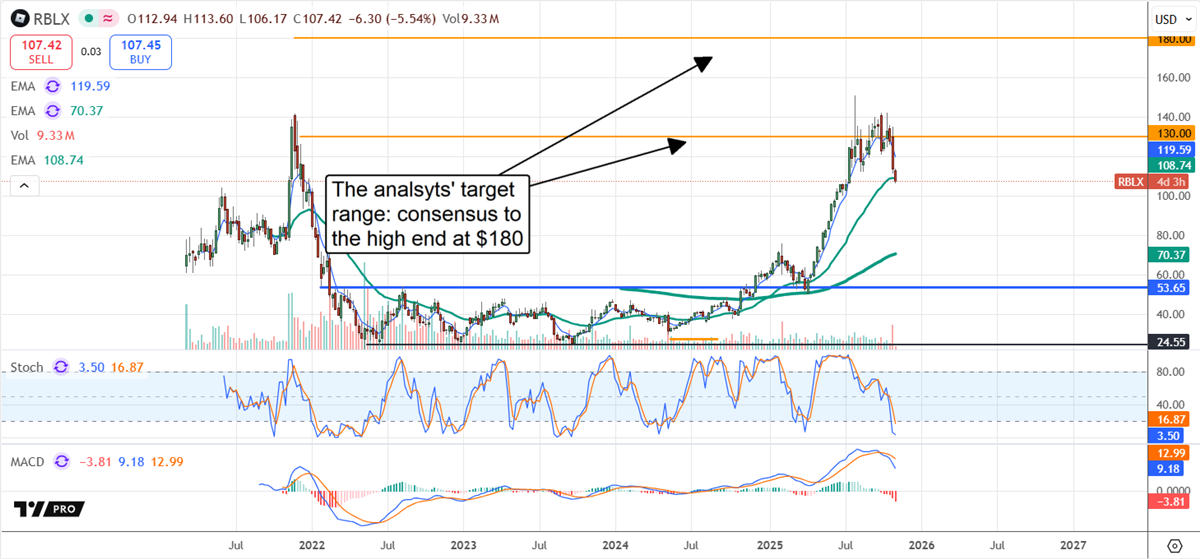

As of early November, consensus forecasts a greater than 20% upside for this stock.

The consensus, up nearly 150% in the preceding 12 months, increased by a few hundred basis points following the release—and the revisions point to even higher levels.

The fresh targets include a new Wall Street high of $180, issued by Goldman Sachs, which represents approximately 75% of the upside from the critical support target. The firm noted user growth, bookings strength, and an outlook for sustainable 20+ growth over the long term as evidence supporting the new target.

The critical support target is the 150-day exponential moving average (EMA). This EMA indicator represents long-term, buy-and-hold, and institutional investors, who have been net buyers throughout the year. The institutional data tracked by MarketBeat shows selling activity in October, aligning with the market’s top, but otherwise bullish for this stock. The group owns approximately 95% of the stock and, on balance, bought the first three quarters of the year, suggesting they will revert to buying in November as shares cool off.

Roblox Pulls Back on Plans for Increased CapEx

Roblox had solid Q3 earnings, with growth accelerating and forward-looking indicators suggesting the trend will continue. The company’s revenue grew by nearly 24% to $1.4 billion, driven by a 70% increase in bookings. Critical details include a 70% increase in average daily users, 90% increase in hours engaged, and 103% improvement in free cash flow.

However, the stock dipped following the Q3 earnings report, largely due to guidance and planned increases in capital expenditures (CapEx).

This pullback appears to be a knee-jerk reaction to increased spending, spending that will pay off in spades down the road.

The company is in the midst of an investment ramp intended to catch up with its growing user count and bookings growth.

Through CapEx on expanding infrastructure and building and expanding partnerships, Roblox will ensure scalability over time.

Regarding the guidance, the company forecasts revenue growth in the 40% range, accelerated bookings growth, and positive free cash flow. Roblox's balance sheet suggests that increased CapEx is not a red flag, provided it is offset by higher revenue and earnings quality. Highlights include more than $5 billion in cash and equivalents, low leverage, and equity that rose by nearly 100% and is expected to continue improving.

Profit-Taking Caps Gains in RBLX Shares

While fears of increased losses sparked the sell-off in Roblox shares, it is profit-taking that is keeping them down. Up approximately 180% from April to September, the stock presented a healthy opportunity for profit-taking that may cap gains until later in the year.

Now down 30% from its peak, the market faces a significant overhang that can take time to clear. Visible catalysts include upcoming earnings releases in which outperformance may be expected.

Learn more about RBLX