5 Stocks to Buy in August With Tremendous Upside Potential

The market is shaping up to have a solid August. Tariff risks aside, the underlying economic fundamentals remain healthy, supporting an outlook for earnings growth, and capital returns continue to flow.

These five stocks stand out as August buys, with strong earnings momentum and bullish analyst sentiment suggesting more upside ahead—especially as upcoming reports may be catalysts.

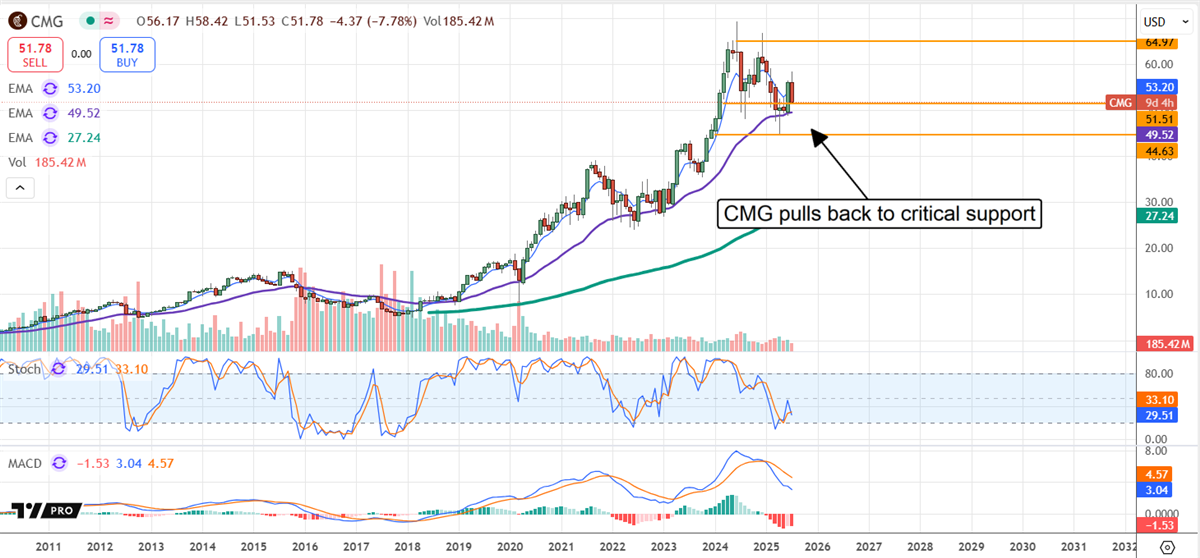

Chipotle Mexican Grill to Sustain Double-Digit Growth

Chipotle Mexican Grill (NYSE: CMG) is on track to sustain a solid double-digit growth pace supported by store count growth, comparable store sales growth, and an international expansion.

The international expansion is a critical factor, as it could lead to quadruple-digit revenue growth over time. The highlights in 2024 and early 2025 include a moderately increased pace of activity, with new deals signed and the international project pipeline growing.

Meanwhile, the CEO transition has gone smoothly, allowing the market to consolidate smoothly within its trading range and set itself up for a rebound.

As of late July, the analysts' trends support the outlook for higher share prices, with increased coverage, firming sentiment, a solid Moderate Buy rating, a forecast for a 20% upside, and an uptrend in revisions.

Starbucks: The Niccol Effect Is Taking Hold

It takes time to turn a ship as big as Starbucks (NASDAQ: SBUX), but Brian Niccol is doing it. The company is working hard to reinvigorate its culture, improve store flow-through, and divest itself of cumbersome assets, such as the China business.

The takeaway is that Starbucks is on the cusp of significant improvement in all operating metrics, specifically regarding cash flow and balance sheet health, on track to resume and sustain high-quality earnings growth, and capital returns.

And the analysts like what they are seeing. The trends in June and July include numerous bullish reports and comments that underscore the opportunity.

While the group maintains a consensus of Hold and views the stock as fairly valued in late July, the trends indicate a move to the high end of the range, and new highs are expected as the year progresses.

Amprius Technologies: Small Cap About to Be a Mid-Cap

Amprius Technologies (NYSE: AMPX) is an emerging battery technology company supported by its industrial advantage, which holds the potential to revolutionize the entire battery market.

Its silicon anode lithium-ion batteries have improved energy density and discharge compared to traditional batteries, making them well-suited to a range of applications, including drones.

The story in summer 2025 is that production capacity is ramping, production is increasing, orders and backlog are growing, and revenue is rising significantly. The company is forecasted to grow at a hyper-triple-digit pace for several quarters and is likely to outpace its estimates.

The price action in July reflects growing support and a strengthening market that can easily take its price to the high end of the analysts’ range, near $15, another 50% upside.

Soundhound: Agentic AI Boom Is About to Begin

Soundhound’s (NASDAQ: SOUN) voice-activated services will be central to the agentic AI boom. They are already gaining momentum with new business in new verticals and deepening penetration of clients.

It, too, is amid a hyper-growth phase and will likely outperform estimates set in mid-2025.

As it stands, the analysts forecast about 150% year-over-year revenue growth at the consensus for Q2, the second quarter, at that pace, and acceleration is expected in the next fiscal year.

The balance sheet is another reason to buy this stock; Soundhound is primarily self-funding its growth and has a fortress-like balance sheet, ensuring it can execute its plans and build shareholder value effectively.

Northrop Grumman: A Defense Stock Apart From the Rest

The defense industry is well-positioned to benefit from increased government spending globally.

However, Northrop Grumman’s (NYSE: NOC) second-quarter results set it apart from the pack, including better-than-expected top and bottom-line results and improved guidance.

Among the critical details are the near-double-digit increase in backlog, which supports the idea of revenue growth acceleration and the safety of capital returns, as well as the technical price action that resulted.

The stock advanced more than 8%, breaking out of a long-term trading range and signaling a continuation of the bull market.