Can Travis Kelce Spark a Six Flags Turnaround?

Usually, headlines about Travis Kelce demanding six flags mean a defensive lineman has lightly touched Patrick Mahomes.

But in this case, Kelce is part of an activist group focused on Six Flags Entertainment Corp. (NYSE: FUN), the theme park operator that frequently induces nausea among both guests and shareholders.

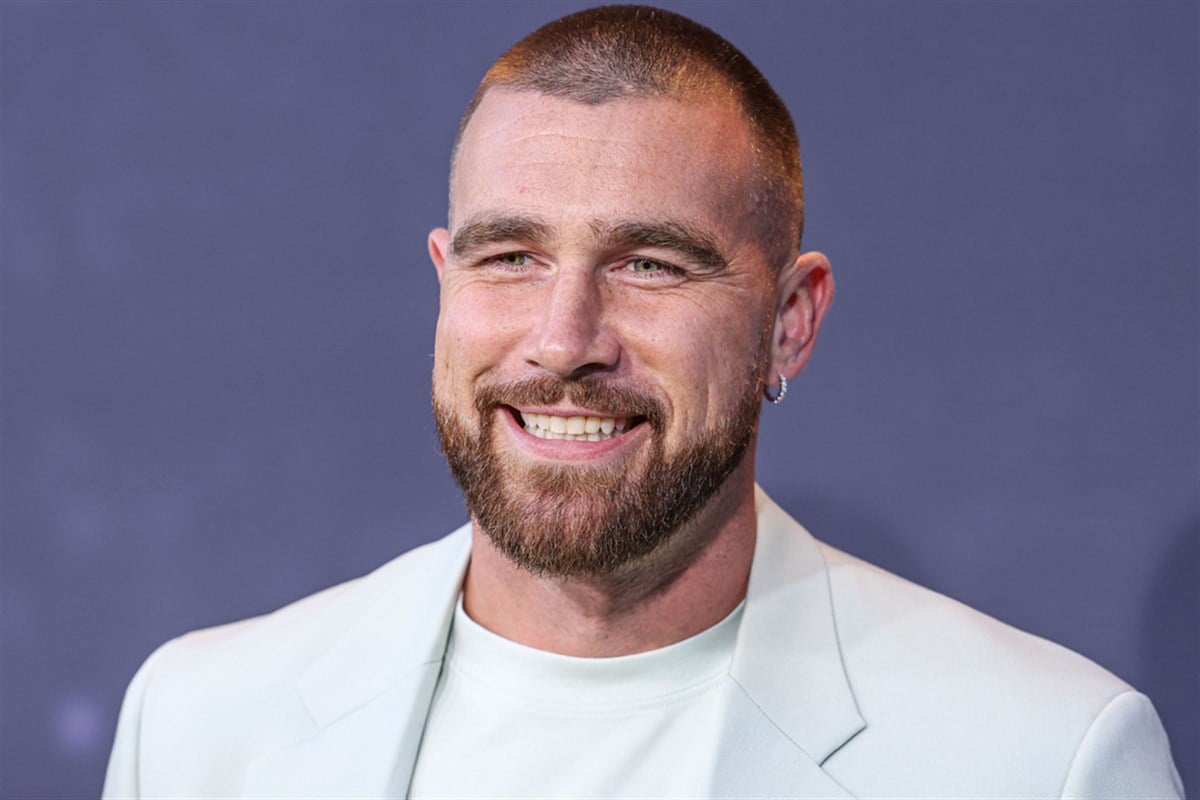

Kelce is the spearhead of an investment group from Jana Partners that seeks to reevaluate the company’s operating strategy and unlock the brand’s underlying potential. It won’t be easy.

Six Flags' Premiumization Strategy Failed to Meet Its Goals

Six Flags shares have been under pressure since 2017 due to an ineffective rebrand aimed at high-end guests and a merger with Cedar Fair that has failed to deliver dividends. Publicly traded theme parks are a unique industry and even more reliant on positive sentiment than most consumer discretionary stocks.

Since the trip lasts only a day, theme parks must sell a high-value experience, and Six Flags pivoted to a more premium business model in 2021 to attract higher-end clientele.

Former CEO Selim Bassoul introduced the premiumization plan in 2021, jacking up prices to narrow the customer base to the highest-propensity spenders. In theory, this strategy would reduce lines and wait times, enhance the customer experience and encourage guests to spend more on amenities.

But while the strategy did increase guest spending per capita, overall attendance suffered and revenue from wealthier clients failed to meet the gap.

Additionally, the focus on premiumization alienated the typical Six Flags attendee: middle-class families looking for a budget-friendly day trip rather than a destination vacation. Bassoul’s comments about preventing Six Flags parks from becoming “cheap daycare centers” likely didn’t help matters either.

It’s hard to view the premiumization strategy as a successful pivot. The stock initially popped when reports came out that guest spending was up 17%, but the wealthier clientele failed to experience good bang for their buck, while Six Flags' more traditional base was iced out.

The stock is down 3% over the last five years, and Bassoul went from CEO to executive chairman to out of the company by October 2025.

Activists Offer Plans to Alter Premiumization Model

Six Flags faces a difficult situation. The company has strong brand recognition and sits on plenty of valuable real estate, but earnings have lagged, and activists have their sights set on the flailing firm.

Travis Kelce is one of the most recognizable faces in the NFL. He is a three-time Super Bowl champion with the most famous fiancée on the planet, Taylor Swift. But he also attests to being a true fan of the parks from his childhood and connecting with the company personally. He also brings a celebrity atmosphere that new activists can use to alter the premiumization model.

The Kelce-led group from Jana Partners has a multi-pronged plan to awaken the venerable Six Flags brand from its slumber. Some of the group's primary goals include:

- More Immersive Experiences - Enhancing guest experience is a big part of Kelce’s involvement. By enlisting top athletes (and other recognizable celebrities), Six Flags can make trips to the park feel like once-in-a-lifetime events where customers can meet their favorite personalities and watch performances while waiting for roller coasters.

- Technological Modernization - Part of the Jana group’s plan includes modernizing the company’s dated tech. Whether waiting for refreshments or standing in line for a ride, tedious and friction-filled queue experiences have plagued Six Flags’ complaint boards. Speeding up queue efficiency through technological upgrades is one of Jana’s most significant initiatives.

- Real Estate Reinvention - Jana Partners isn’t the only group interested in Six Flags. Land & Buildings Management (L&B) is interested in the underlying real estate, which it views as undervalued compared to Six Flags’ current market cap. Six Flags carries a sizable debt load, and L&B wants to unlock value by implementing a PropCo/OpCo model. By offloading the real estate burden, Six Flags can better manage its debt load and open up funding for Jana Partners’ initiatives.

Chart Shows Promising Momentum, But False Breakouts Have Been Common

Turning Six Flags around in an increasingly K-shaped economy will be a challenge, and the stock is down more than 45% year-to-date. However, Kelce and his partners have sparked optimism in the stock for the first time in years.

FUN shares experienced a blitz of support following the announcement, jumping more than 15% over the three sessions that followed. The stock has been battling resistance at the 50-day simple moving average (SMA) since March, and while the recent breakdown has been one of the most forceful breaches, false signals have been common.

Is it different this time? One potential hint lies in the Moving Average Convergence Divergence (MACD) indicator, which is poised to register its first bullish crossover since April. The share price breaking through the 50-day SMA with confirmation from the MACD is one of the strongest bullish signals in months, but the stock is still heavily shorted and frequently misses earnings expectations.

Optimism is brewing, but it will likely take a few quarters of concrete proof before FUN shares can make a sustained reversal.

Learn more about FUN