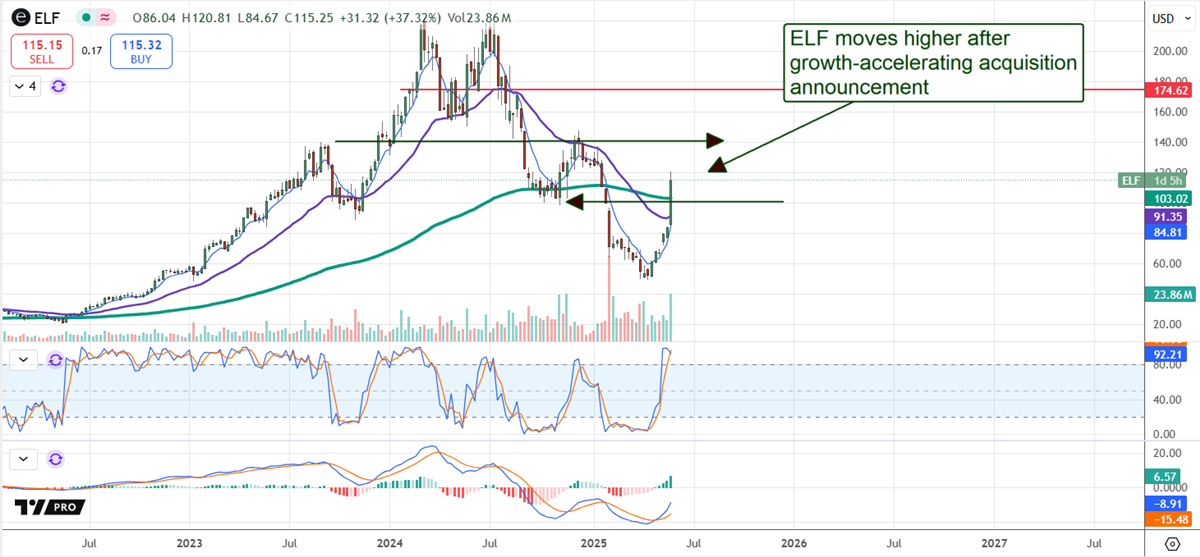

e.l.f. Gets Back on the Shelf! It’s Not Too Late to Buy In!

e.l.f. Beauty (NYSE: ELF) declines to offer guidance for the year, but investors don’t care. The uncertainty brought by tariffs was offset by a $1 global price increase and plans to acquire Rhode.

In the words of CEO Tarang Amin, Rhode is a breakthrough high-growth brand, one now expected to help the company continue to grab market share and sustain growth. Meanwhile, the FQ4 and full-year fiscal 2025 are solid.

The company’s disruptive position continues to drive favorable results, including industry-leading growth, widening margins, and an outlook for sustainable, long-term growth.

Profitable e.l.f. Outperforms in FQ4; Has Momentum Going Into FQ1

The impact of tariffs aside, e.l.f. Beauty had a solid quarter and year in Q4 and for the fiscal year 2025. The company reported $332.65 million for the quarter, up 3.6%, slower than in previous quarters but sufficient to outpace MarketBeat’s reported consensus by nearly 200 basis points.

The strength was driven by gains in retail and eCommerce channels and both operational regions. Sales in the U.S. were bolstered by market share gains, marking the 25th consecutive month of double-digit share gains in the core territory.

Margin news is also good. The company benefited from foreign exchange (FX) tailwinds, resulting in a lower cost of goods, compounded by reduced spending. The net result is increased gross and operating margins, as well as outperformance on the bottom line.

The adjusted $0.78 is more than 800 basis points ahead of the consensus, up nearly 50% year-over-year, and is likely to remain strong in the absence of tariffs.

The critical detail is the cash flow, which was sufficient for a cash build and an increase in equity despite share buybacks. The buybacks reduced the count by an average of 0.85% for the quarter, and the cash build is impressive, up 50% year-over-year.

Equity has increased by nearly 20% over the last year, positioning the company well for its next purchase. The company’s total liability, including long-term debt, is less than 1x its equity and 2x its cash. The deal for Rhode is worth $800 million in cash and stock upfront, with an additional $200 million upon milestones, and is expected to close before mid-year.

Analysts Lead e.l.f. Beauty Stock Price Targets Higher

The initial analysts’ response to e.l.f.’s results and acquisition plans is favorable. Analysts at Bank of America see improving consumption trends and the acquisition driving momentum for the business, while they and others are lifting their stock price targets.

The fresh targets put this market near $115, which is significant because these revisions affirm a shift in sentiment that began early in May. With this in play, the analysts not only mitigate headwinds put in place in 2024 but also strengthen tailwinds that may continue to gain momentum as the year progresses.

The results and analysts’ response triggered a short squeeze in e.l.f.’s stock price. Short interest was off its peak in the mid-May report, but sufficiently high for a short squeeze at 12%. The risk is that shorts will reposition at a higher level and cap gains; however, this is unlikely, given the current outlook.

Tariffs are an unknown with reciprocal tariffs on China in place, but potentially quashed by the courts, and efforts are underway to improve the supply chain. e.l.f.

Beauty Has Considerable Exposure, With Roughly 75% of Its Products Sourced From China

The technical outlook is robust. The results and acquisition news triggered a 25% stock price increase, confirming the bottom while putting the market above critical moving averages. Exponential moving averages, such as the 30-month and 150-day, represent long-term, buy-and-hold investors and institutional money. A move above them signals a bullish shift in sentiment and opens the door for additional upside. The targets for resistance are $140 and $175.