Etsy Partners With OpenAI—What It Means for Investors Now

Etsy’s (NASDAQ: ETSY) new partnership with OpenAI has it on track to improve its results. The company will utilize ChatGPT to facilitate instant, AI-powered checkout for select items.

The move helps solidify Etsy as an AI provider of choice for eCommerce solutions—the only problem is that it will take time for significant improvement to be reflected in the results, and the market is stacked against investors in October.

The takeaway is that ETSY has become a buyable stock again. Still, investors should be prepared for volatility over the coming months, time their entries carefully, and avoid chasing prices higher.

Etsy: Market Shifts Drive Volatility, Buy It on the Dips

Details, ranging from short interest to institutional and analyst activity, suggest that this stock’s volatility could be significant. Starting with the institutions, they own a substantial 99% of the stock and will have an outsized influence on its price movement. While their support is broad-based and the group bought on balance in the first three quarters of the month, the bulk of shares, about 50%, are owned by the top five, and there are reasons for them to sell. The reason is indexing.

Etsy decided to move its listing to the NYSE, which means NASDAQ-indexed funds will have to sell, while others will have to buy. The reason is simple. The NYSE has stricter requirements and a reputation for listing higher-quality, better-established companies. The hope is that this move will bolster its visibility and increase institutional interest. This move is scheduled for Oct. 13.

Analyst activity is equally significant. MarketBeat tracks 29 analysts rating this stock, a relatively high number and well-above average, signifying broad-based market support. Their trends reveal increased coverage, which is otherwise bullish for the market, but the sentiment is only Hold, and the price targets have been falling. The consensus as of early October is a 12% downside with potential to fall further.

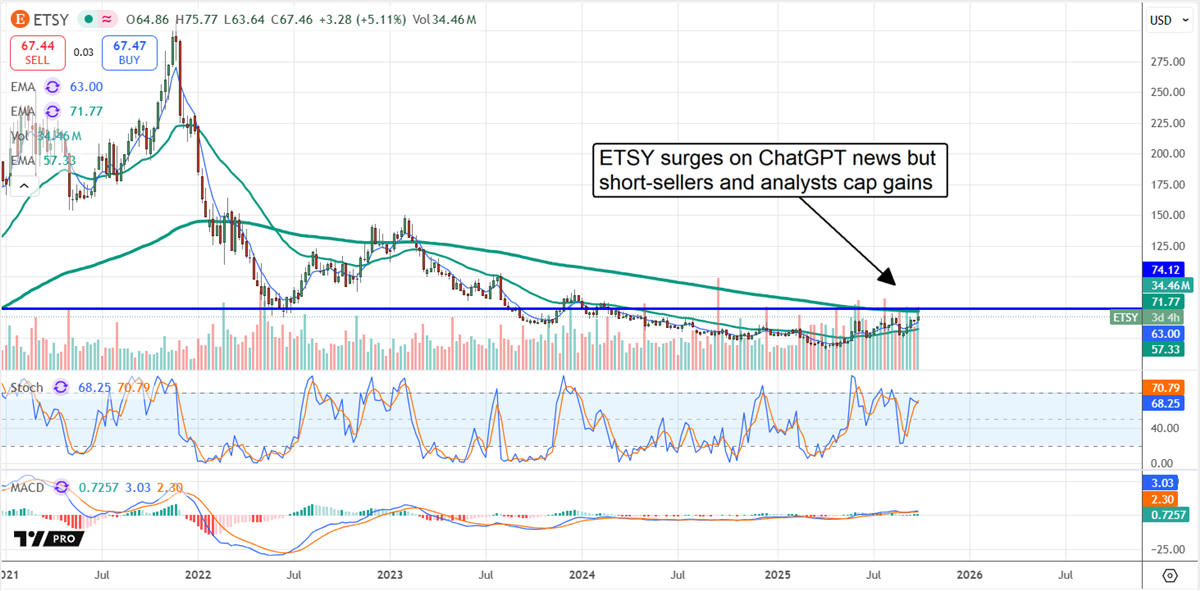

As of mid-September, short interest was high at 20%, making short-covering a probable cause for the late-month rise in the stock price. The bad news is that the price action suggests short sellers repositioned at the higher price point, a price level consistent with prior resistance, the top of a long-term trading range, and a critical long-term exponential moving average. The likely outcome is that Etsy stock will remain range-bound until a more potent catalyst emerges, and the potential for a significant pullback remains. The best-case scenario for potential buyers is for this market to fall to the low end of the trading range, near $50 or lower.

Etsy Can Provide Catalyst With Q3 Results

Etsy is set up to deliver a catalyst with the Q3 results. The analysts forecast a sequential and YOY decline in revenue that likely underestimates consumer strength. The forecast also includes margin improvement, which, when combined with revenue strength, will lead to a solid bottom-line performance and sustained financial strength. Etsy’s balance sheet highlights include a shareholder deficit, but it is due to share buybacks. Etsy’s share buybacks reduced the count by nearly 10% over the preceding 12 months.

The price action in ETSY stock is tepid. The market has moved off its lows in early October, but remains below critical resistance, where resistance to higher prices is present. If the market can’t get above the $75 level soon, the odds are high that it will remain range-bound until the Q3 report, expected at the month’s end. The upshot is that a move to fresh highs will signal a shift in the market. Etsy stock can enter a sustainable rally in this scenario and regain some of the ground it lost since the peak in 2021.

Learn more about ETSY