Is Advanced Micro Devices Stock Ready for Another Run?

Advanced Micro Devices (NASDAQ: AMD) stock is ready for another run higher; all you have to do is ask its investors. They’ll say yes. The question is whether the stock can make another run higher, and the answer is also yes. Late to the AI game, AMD AI accelerators are flooding the market and are boosting the business in Q2. It’s hard to say if AMD will gain market share from NVIDIA (NASDAQ: NVDA) or see a 200% increase in revenue the way NVIDIA did, but it will see substantial growth this quarter and over the coming years for more reasons than AI.

AI and data center accelerators are at the forefront of investors' minds, but legacy semiconductor businesses still exist. The legacy business struggled over the last two years due to over-supply, inventory reduction, and end-market normalization, but normalization is here. With the client and data center segments growing at an 80% clip, it will only take an end to a contraction in the gaming and embedded markets to drive significant top-line acceleration, and those legacy businesses will resume growth in 2025.

There is also the long-term outlook for AI to consider. Embedded and gaming segments are down today but will return to growth soon and participate in a secular grade upgrade cycle that could last more than a decade. AI begins with data centers, but It is moving to the edge of computing and into the IoT, which will drive business in the embedded segment for the next decade.

Analysts Favor AMD: Top Pick Among Large-Cap Chip Stocks

The analyst's activity is mixed in Q2, with numerous price target reductions offsetting price target increases and upgrades. The takeaway is that some analysts are trimming targets, but the group’s range is narrowing as consensus mounts, and they see this stock moving higher.

A significant number of analysts are covering the stock, so conviction is high, and activity is leading the market higher. The consensus sentiment is a firm Buy; the consensus target of thirty analysts is up 50% from last year and $5 in the last 30 days, suggesting a move to the high-end range is likely. A move to consensus puts the market for this stock near the all-time high; a move to the high range would set a new high.

The latest update comes from Piper Sandler, reiterating its Overweight rating and $175 price target. The firm chose AMD as its top pick among large-cap chip stocks for the 2nd half, citing the improving supply of MI-300 and a slate of new chips set to come out later this year, next year, and in 2026. Those include updated versions of the MI-300 and the 2nd and 3rd generation AI platforms, MI350 and MI400, which will compete with NVIDIA’s Blackwell and Ruben architecture.

Advanced Micro Devices Valuation No Concern With Growth Forecasted

Advanced Micro Devices trades at a relatively high 45x this year’s earnings outlook, but it is not a concern for investors. The growth outlook shaves the value considerably as soon as next year, bringing it into a more reasonable range near 27x. Because growth is expected to persist at a high level into 2026, the valuation falls further, putting this stock in deep-value territory. Assuming a 30x valuation for blue-chip tech leaders, this market could advance by $17 to a multi-month high on simple price-multiple expansion, and there is an upside risk. AMD will likely outperform the consensus estimate reported by MarketBeat and raise guidance, adding leverage to potential valuation gains.

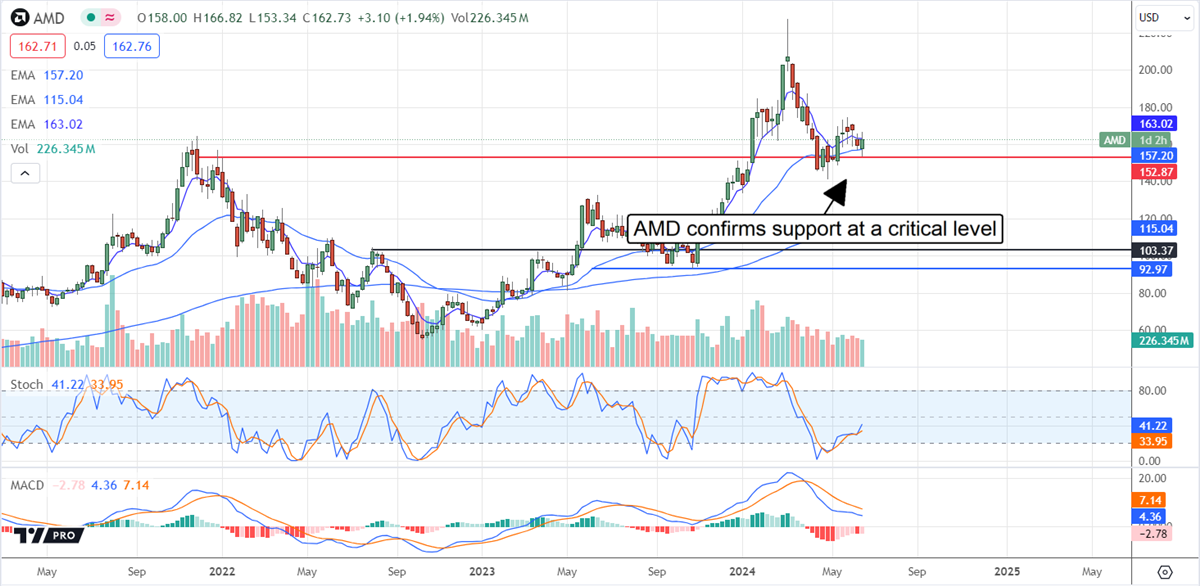

The technical action is promising. The market for AMD stock broke to a new high early in 2024 and corrected to confirm support at the prior high. The market is now showing rising support at the critical level backed by the indicators. MACD is trailing stochastic; momentum has yet to resume bullish behavior, but stochastic is firing a solid entry signal within a market that is uptrending with room to run. In this environment, AMD shares could rebound to $175 soon and $200 by year-end, with a chance of hitting new all-time highs in 2025.