The Most Upgraded Stocks in Q3: Good News for the S&P 500

The changes to MarketBeat’s screen for Most Upgraded Stocks posted since the FQ2 earnings reports were released are significant. These are perhaps the most critical changes in many quarters, as the AI market leaders are back in the analysts’ favor.

Stocks in the ranking include five of the Magnificent Seven stocks, including NVIDIA (NASDAQ: NVDA) and represent more than 30% of the S&P 500 (NYSEARCA: SPY) index. All are ranked in the top ten, and four are in the top five, with some new leaders emerging. The new leaders include the “other” crucial AI names, such as Oracle (NYSE: ORCL), Advanced Micro Devices (NASDAQ: AMD), and now Snowflake (NYSE: SNOW), which is seeing accelerating demand for its data-management services.

The takeaway for investors is that the S&P 500 price action outlook has strengthened. With the market leaders back in the analysts' favor, investors should expect dollars to continue flowing into their markets, driving their stock prices higher and the index along with them.

This is a look at where analysts' trends suggest these stocks' prices are heading.

Alphabet: The Most Upgraded Stock in Q3

Alphabet (NASDAQ: GOOGL) emerged as the most upgraded stock for the cycle with two things driving its price: outperformance and favorable antitrust rulings.

The net result is 44 bullish revisions in the 90 days leading into mid-September, including numerous upgrades and price target increases.

Although the consensus lags the market, indicating a 10% decline, it is up sharply since late July, with revisions leading to another 10% increase, and the trend is likely to continue.

Alphabet’s results reveal strengths in all major reporting segments, led by a 32% increase in Google Cloud.

Meta Platforms: A Close Second as Analysts Praise Results

Meta Platforms (NASDAQ: META) is in a close second place, with MarketBeat tracking 43 positive revisions. The impact on the outlook is that coverage increased, sentiment firmed, and the price target increased.

The analysts are more bullish on this stock, indicating a 5% increase at the consensus and a 25% gain at the high end.

The high-end is among the most recently set targets, strengthening the bullish bias in the data. The chart reflects an uptrend and potential for continuation that could result in the high-end target of $980 being surpassed sometime in early 2026.

The 2025 results include outperformance, with strengths driven by the application of AI and an outlook for continued strength.

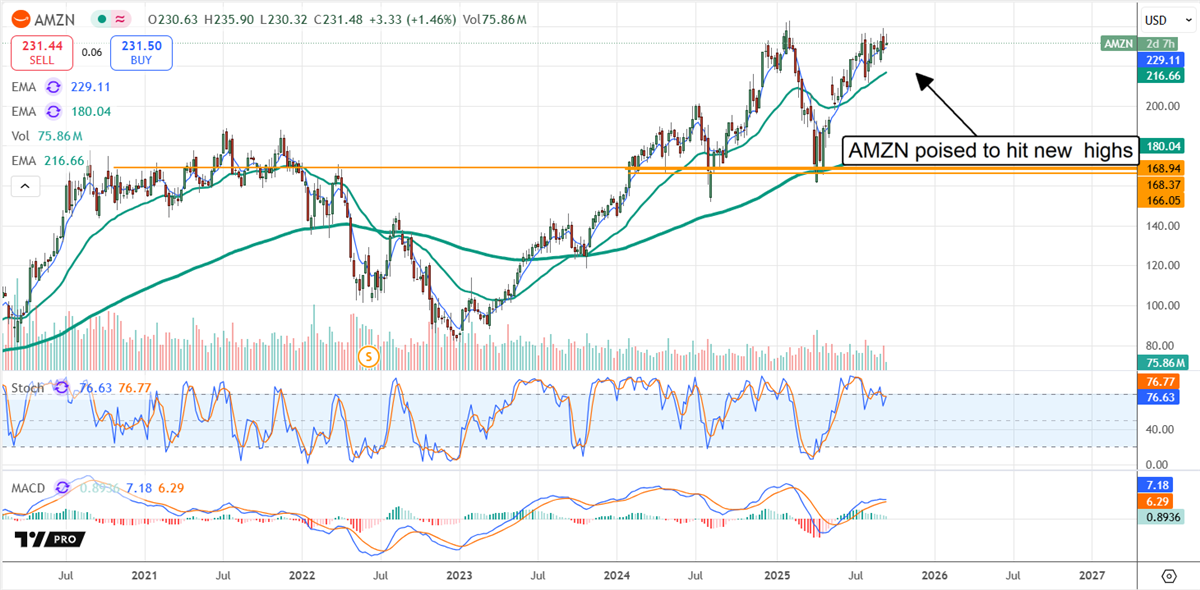

Amazon: On the Verge of a Major Breakout

Amazon’s (NASDAQ: AMZN) analysts issued 37 positive updates in the last three months, including new coverage and upgrades that lifted the consensus sentiment to Buy from Moderate Buy.

The trends also include upward revisions in the price targets and a consensus indicating a 12% upside as of mid-September.

The high-end range adds 15% to it, and the technical indications are similar to Google: moving to new highs indicates a technical movement larger than the analysts' forecast.

Given the outlook for interest rate reduction and its impact on consumer spending (right before the holidays), upcoming results are likely to be strong, and the trend in analysts' sentiment will continue.

Oracle: On Track for a Trillion Dollar Valuation

Oracle’s results, subsequent deal news, and analysts' sentiment trends have it on track for a trillion-dollar valuation. Having risen by more than 30% in under a month, it needs to increase by another 15% to reach the target.

In that scenario, it is on track to oust Berkshire Hathaway from its spot as the 10th largest company and potentially continue gaining value.

The analysts' trends include 37 positive updates, including upgrades and price target revisions. The Moderate Buy consensus rating verges on an outright Buy, and the price target is up sharply.

The consensus, which assumes the market is fairly valued near $300, is up 85% in the preceding 12 months and nearly 35% in the preceding 30 days, with the high-end range forecasting a move to $410, another 30% of upside.