Biggest whale in Digital Currency is buying 2 tonnes of gold… per week! (From Golden Portfolio)

What You Need to Know

- Consumer staples stocks offer capital preservation, low volatility, and reliable dividend income during uncertain markets.

- Waste Management, British American Tobacco, and Service Corporation International each serve inelastic demand niches with strong dividend profiles.

- Technical setups across all three stocks suggest potential upside, reinforcing their appeal as defensive investments.

The best offense is sometimes a good defense, and that’s especially true in markets when stocks turn volatile. Defensive stocks can preserve capital in a declining market by limiting losses and supplementing portfolios with dividend income. Some market sectors offer better protection than others, and today we’ll look at one of the common defensive sectors: consumer staples.

WARNING: $7 TRILLION Event Imminent. Most Americans Unprepared (Ad)

This isn't a boom where everyone wins. It's a transfer from one group to another—like railroads (1800s) and internet (1990s). Louis Navellier, who spent 46 yrs on Wall St., built the grading system institutions paid $24,000/yr for him to evaluate stocks with. Now, his system shows exactly where the $7 trillion is flowing. And it's not AI.

Click here for the full story.

Consumer Staples Stocks Can Protect Capital in Volatile Markets

Most investors think of gold or U.S. Treasuries (at least for now!) when the discussion turns to safe haven assets, but capital doesn’t necessarily need to exit the stock market to be protected. Some sectors are less volatile than others, while others offer income through dividends in addition to equity appreciation. And then some offer a combination of both, such as consumer staples.

Consumer staples are considered a ‘safe’ sector because they comprise companies that sell necessities rather than discretionary goods. Consumers purchase items like groceries and toiletries in a consistent, timely manner, which limits upside but offers predictable, reliable revenue. Other factors that make staples a popular investment during volatile markets include:

- Steady Dividend Income - Predictable revenue leads to reliable profits, and these companies often return these profits to shareholders as dividends. Reliable earnings are key to dividend safety, and consumer staples stocks are rarely at risk of dividend cuts.

- Pricing Power - The ability to pass rising costs onto consumers is crucial in the age of tariffs and inflation. Consumer staples possess a unique ability to pass on costs since there’s no substitute or ‘trade down’ for life’s necessities. A family can choose to get takeout instead of eating at a steakhouse, but they can’t forgo or substitute toilet paper, toothpaste, or soap.

- Low Beta - Beta is a useful heuristic for measuring a stock’s volatility relative to a broader index or market. Low beta stocks are less volatile than the broader market, and these are the types of stocks institutional investors look for when markets get turbulent. Consumer staples often offer relief from market volatility, preserving investor capital during steep drawdowns.

3 Consumer Staples With Inelastic Product Demand

The following three stocks all have inelastic demand for their products and services, though they aren’t the traditional grocery-store items you might expect. Each company has a foothold in its niche market, offering steady income and strong dividends.

Waste Management: Strong Dividend and Irreplaceable Infrastructure

Whoever coined the phrase “one man’s trash is another man’s treasure” probably didn’t have actual trash in mind, but Waste Management Inc. (NYSE: WM) depends on American households and businesses throwing away tons of stuff every week. But Waste Management’s moat doesn’t come from trash removal as an essential service; it's the company’s vast network of landfills that gives it a near-monopoly in many of the locations it operates.

Environmental regulations make landfill permitting extremely difficult and time-consuming to obtain, so Waste Management’s hold on market share is as safe as its dividend, which has a 52% dividend payout rate (DPR) and a 22-year history of annual payout increases.

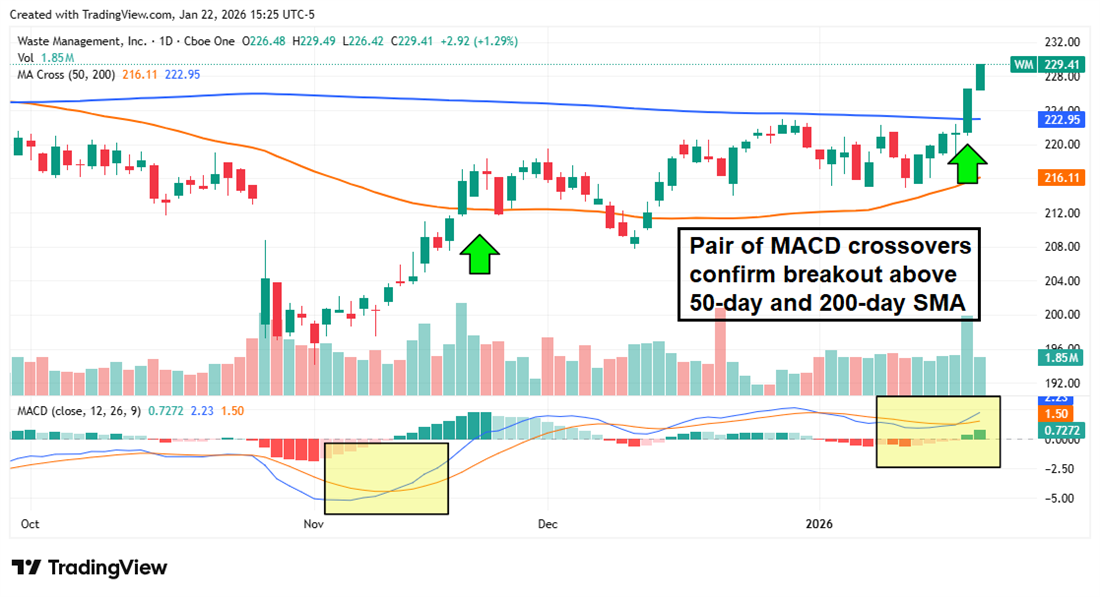

WM shares are also in the midst of a breakout, with the price eclipsing the 200-day simple moving average (SMA) for the first time since last September. The bullish trend actually began in November when the Moving Average Convergence Divergence (MACD) initiated a bullish cross, and now a second cross has confirmed the next leg up in the rally.

British American Tobacco: Deep Value With Premium Dividend

Cigarette smoking may be in secular decline, but British American Tobacco plc (NYSE: BTI)’s pivot to smokeless products like e-cigs, vapes, and nicotine pouches has reinvigorated the company’s revenue in the U.S. But, as with most tobacco companies, the appeal lies in the dividend, and BTI currently yields more than 5% with a 63% DPR. The company has raised payouts for 19 straight years, but the low growth rate means the stock often functions like a bond in bull markets.

In this current bull market, BTI shares have returned nearly 60% in the last 12 months, and the stock could be ready for its next move up after a period of consolidation. A bullish wedge has formed on the chart, with the upper bound forming resistance at the previous all-time high and the lower bound making higher lows.

Traditionally, a new uptrend begins when the stock price breaks above this upper level, and the MACD and Relative Strength Index (RSI) signal that bullish momentum is gathering strength.

Service Corporation International: A Necessary Service That Can’t Be Outsourced

Here’s a company where the clients never actually know when they’re using the service. Service Corporation International Inc. (NYSE: SCI) is the largest provider of funeral and cemetery services in North America, where an aging population faces some unfortunate demographic inevitabilities. If you’re lucky enough to be unfamiliar with this business model, Service Corp accepts payment upfront for future funeral and burial arrangements, as most clients want to offload the burden of ‘deathcare’ from their loved ones before they pass. Pre-payment allows the company to build a large pool of capital that can be deployed in interest-earning vehicles.

SCI’s cash position allows it to sustain a healthy dividend, currently yielding 1.68% with a 36.7% DPR. The dividend has grown at a 10.57% annualized rate over the last five years, and the company has raised the payout for 15 consecutive years. The company also raised its 2025 cash flow guidance to the $915 million to $950 million range during its Q3 earnings report, which should help support another year of payout increases.

Companies like SCI usually don’t offer outsized stock returns. Still, a little capital appreciation on top of a steady dividend is ideal in volatile markets, and the chart here shows some promise. The RSI bounced off the Oversold level in December and has been trending higher ever since, and the share price has now broken through the 50-day and 200-day SMAs for the first time since late October.

Recommended Stories

- GE Vernova’s Q4 Was Strong—But the Backlog Number Matters More

- Frontrunning the news with this gold stock (From Golden Portfolio)

- The Time to Buy ServiceNow Is Now: Oversold and Ready for a Rebound

- Buy AES Immediately (From Chaikin Analytics)

- 3 Emerging Market Stocks Leveraging South America’s Momentum

- 2 Bitcoin ETFs to Avoid—and 1 to Watch in 2026

- MarketBeat Week in Review – 01/26 - 01/30

Stay Ahead of the Market

The best investment opportunities don't wait. Get our research and stock ideas delivered straight to your smartphone—so you never miss a market-moving opportunity. Our text alerts ensure you see timely stock ideas and professional research reports instantly, whether you're in a meeting, commuting, or away from your desk.